|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

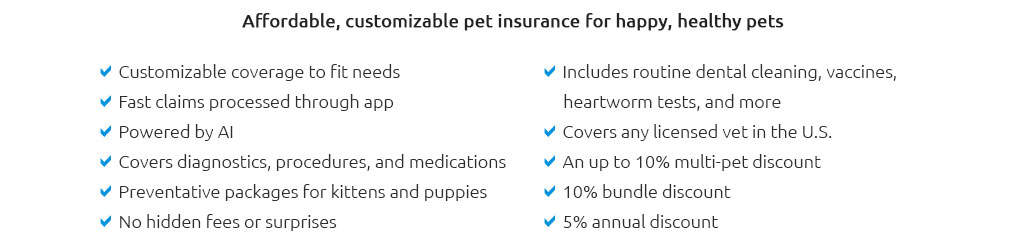

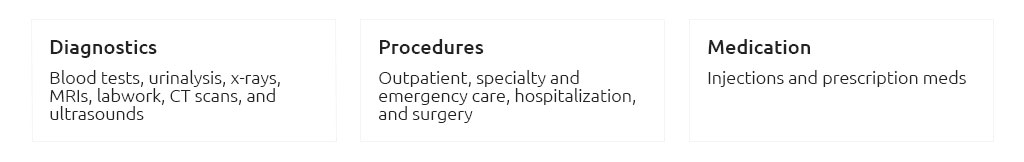

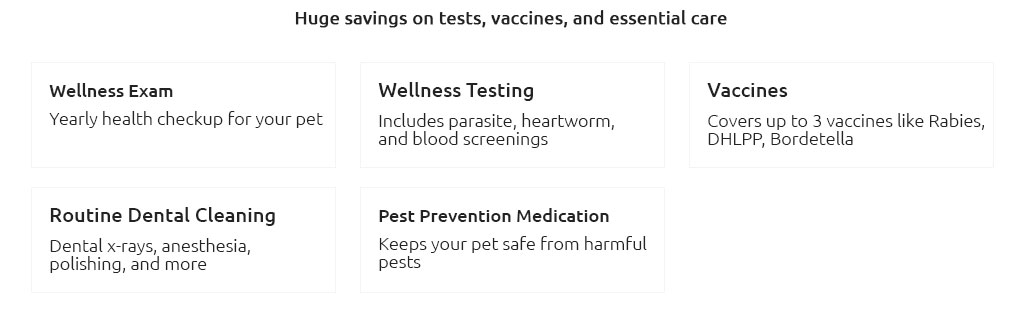

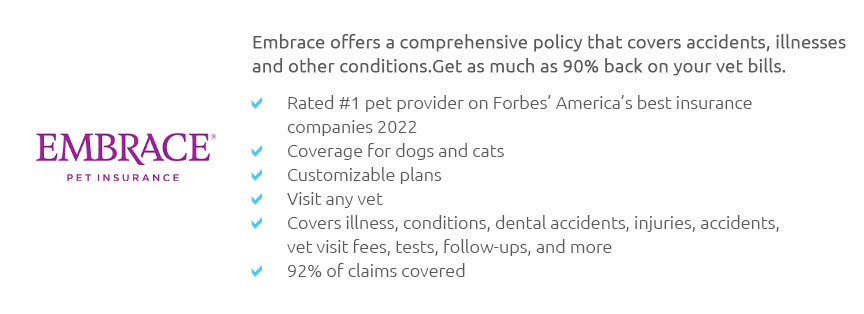

cat insurance michigan guide for smarter, stress‑free vet billsWhy coverage mattersFrom Detroit to Marquette, cats face different risks: icy sidewalks can irritate paws, indoor toxins spike in winter, and surprise illnesses never check the forecast. A solid cat insurance plan helps turn unpredictable vet costs into a manageable monthly expense, so you can focus on cuddles, not invoices. Many insurers serving Michigan reimburse care from licensed veterinarians statewide, which is helpful if you split time between college towns and cottage country. What policies usually includeTypical plans cover accidents, new illnesses, diagnostics, prescriptions, and sometimes dental trauma; wellness add‑ons may handle vaccines or flea prevention. Watch for waiting periods, exclusions for pre‑existing conditions, and how reimbursement and deductibles interact. Read the sample policy-every line matters.

Budgeting tipsChoose a higher deductible to lower premiums, keep a small reserve fund, and pair insurance with consistent preventive care. A balanced plan plus routine checkups is a smart, long‑term strategy for Michigan cat families. https://www.michigan.gov/mdcs/employeebenefits/voluntary-benefits/new-voluntary-benefits/pet-insurance

Pet Insurance provides reimbursement for vet visits due to accidents and illnesses. Coverage is available for cats, dogs, birds, and exotic animals. https://www.lemonade.com/pet/explained/michigan-pet-insurance-guide/

Yes, since we work on a reimbursement basis you can use your Lemonade pet insurance policy at any licensed vet in the U.S., including Michigan. How can ... https://www.petinsurance.com/whats-covered/michigan/

Find the right plan for your dog, cat, or exotic pet. Whether you live in Detroit, Lansing, or Grand Rapids, we provide insurance coverage for pets all across ...

|